Maryland Pay Scale

Understanding Maryland’s Pay Scale: A Comprehensive Guide

Maryland’s pay scale is a critical component of the state’s workforce management, influencing everything from public sector compensation to private sector benchmarks. This guide delves into the intricacies of Maryland’s pay scale, exploring its structure, influencing factors, and implications for employees and employers alike.

The Foundation of Maryland’s Pay Scale

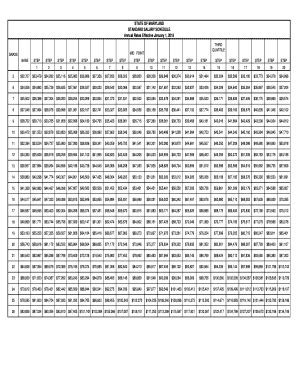

Maryland’s pay scale is primarily governed by the State Personnel Management System (SPMS), which categorizes jobs into classes and assigns corresponding salary ranges. These ranges are determined by factors such as job complexity, required qualifications, and market competitiveness. For example, the Maryland Department of Budget and Management (DBM) publishes an annual salary schedule that outlines pay grades for state employees, ranging from entry-level positions to executive roles.

Factors Influencing Maryland’s Pay Scale

- Cost of Living: Maryland’s high cost of living, particularly in areas like Baltimore and Montgomery County, necessitates competitive wages. According to the Bureau of Economic Analysis (BEA), Maryland’s cost of living index is 12% higher than the national average.

- Industry Demand: High-demand sectors like cybersecurity, biotechnology, and healthcare often offer salaries above the state average. For instance, cybersecurity professionals in Maryland earn an average of $110,000 annually, reflecting the state’s status as a hub for federal agencies and tech companies.

- Union Influence: Unions such as the American Federation of State, County, and Municipal Employees (AFSCME) play a significant role in negotiating pay scales for public sector workers, ensuring fair compensation and benefits.

Comparative Analysis: Maryland vs. Neighboring States

To understand Maryland’s pay scale in context, it’s essential to compare it with neighboring states like Virginia and Delaware.

| State | Average Salary | Cost of Living Index | Key Industries |

|---|---|---|---|

| Maryland | $65,000 | 112 | Cybersecurity, Healthcare, Tech |

| Virginia | $63,000 | 108 | Defense, Tech, Government |

| Delaware | $60,000 | 105 | Finance, Manufacturing, Chemicals |

Historical Evolution of Maryland’s Pay Scale

Maryland’s pay scale has evolved significantly over the decades. In the 1980s, the state introduced a standardized classification system to streamline compensation. The 2008 recession led to budget cuts and salary freezes, impacting public sector wages. However, recent years have seen efforts to address wage stagnation, with 2023 legislation proposing a $15 minimum wage for state employees.

Future Trends: What’s Next for Maryland’s Pay Scale?

Several trends are shaping the future of Maryland’s pay scale:

1. Remote Work Impact: The rise of remote work is shifting salary expectations, as employees compare Maryland wages with those in lower-cost regions.

2. Automation and AI: Industries like manufacturing and logistics are adopting automation, potentially reducing demand for certain roles while increasing salaries for tech-savvy workers.

3. Legislative Changes: Proposed bills aim to address wage disparities, particularly in low-income sectors like retail and hospitality.

Practical Application: Navigating Maryland’s Pay Scale

For employees, understanding Maryland’s pay scale is crucial for negotiating salaries and planning careers. Here’s a step-by-step guide:

Frequently Asked Questions (FAQ)

What is the average salary in Maryland?

+The average salary in Maryland is approximately $65,000, though this varies by industry and location.

How does Maryland’s minimum wage compare to the federal minimum wage?

+Maryland’s minimum wage is $13.25 per hour as of 2023, significantly higher than the federal minimum wage of $7.25 per hour.

Are Maryland state employees eligible for annual raises?

+Yes, Maryland state employees are eligible for annual step increases and cost-of-living adjustments, subject to budgetary approval.

How does Maryland’s pay scale impact small businesses?

+Small businesses in Maryland must compete with larger employers offering higher wages, often necessitating creative benefits packages to attract talent.

Conclusion

Maryland’s pay scale is a dynamic system shaped by economic, legislative, and industry-specific factors. Whether you’re an employee negotiating a salary or an employer benchmarking compensation, understanding this system is essential for success. By staying informed and adapting to emerging trends, stakeholders can navigate Maryland’s workforce landscape effectively.

Final Takeaway: Maryland’s pay scale reflects the state’s commitment to fair compensation, but ongoing challenges like wage disparities and economic shifts require continuous attention and adaptation.